CTC Full Form

The full form of CTC is Cost To Company. Since CTC includes all the components of the salary that an employee receives, it includes multiple components that are not a part of the gross salary of the employee. Hence, to understand the concept fully, we need to check out related terms such as gross salary, net salary, in-hand salary, basic salary, and more.

What is CTC?

CTC or Cost To Company is the amount spent by the employer on an employee, usually defined for a financial or calendar year. It includes all the components that a company spends on an employee in a financial year. As a result, it is the amount quoted during interviews when negotiating the annual salary with the candidates.

So, let us begin by understanding the key components of CTC.

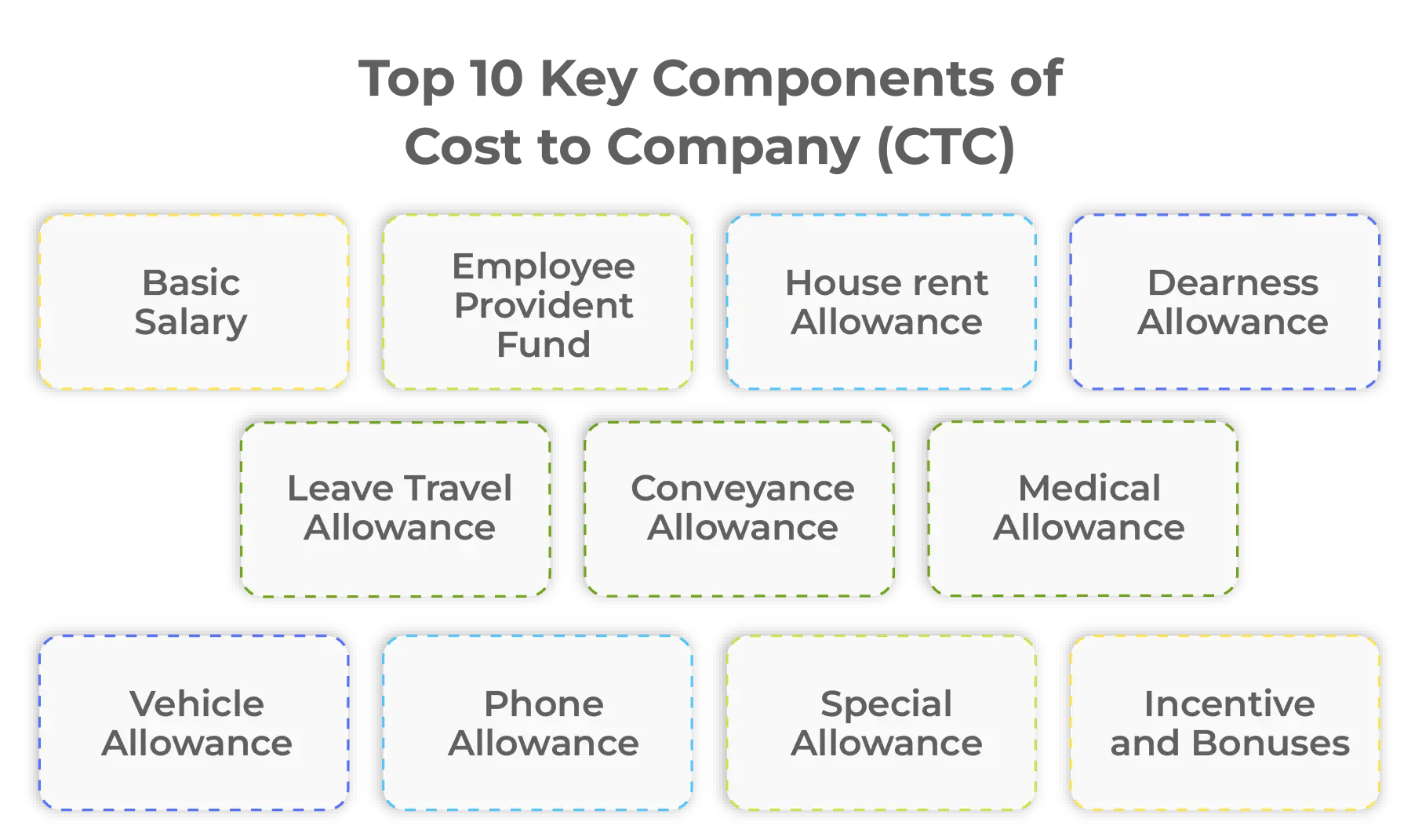

Key Components of CTC

The Cost to Company (CTC) includes the following components usually:

1. Basic Salary

The ‘Basic Salary’ is the main component of the salary that an employee receives. The other components of their salary are calculated to be specific percentages of the basic salary.

2. Employee Provident Fund (PF)

The Employee Provident Fund is 12% of the basic salary and it is deducted from the salary as a part of their retirement plan, which is mandated by the Government.

3. House Rent Allowance (HRA)

The House Rent Allowance is provided to the employee for renting out their stay. As a result, it is set based on the current real estate pricing to ensure adequate accommodation.

4. Dearness Allowance (DA)

The Dearness Allowance helps the employee cope with inflation as it helps in increasing the overall salary amount, increasing their in-hand payment.

5. Leave Travel Allowance (LTA)

The Leave Travel Allowance enables the employee to travel on leave. Hence, it aids them in enjoying their vacations, which adds to their engagement with their organization.

6. Conveyance Allowance

Since the employee is required to commute to work daily, they are compensated with ‘Conveyance Allowance’. This allowance can also include taxi fares apart from public transport charges.

7. Medical Allowance

Medical Allowance is the amount provided to the employee to take care of their well-being. It enables them to pay their medical expenses on time.

8. Vehicle Allowance

Vehicle Allowance is the component provided to the employee to compensate for their daily commuting expenses. It allows them to take care of their daily transport easily.

9. Phone Allowance

Similarly, ‘Phone Allowance’ is the amount provided for compensating against their phone bills as they use their mobile for both personal and official usage.

10. Special Allowance

Special Allowances are provided to compensate for those expenses which cannot be categorized against any other allowance.

11. Incentives & Bonuses

Incentives and bonuses are provided to the employee to reward their exceptional work for their organization. It helps them feel rewarded and motivates them to work harder.

How to Calculate CTC?

CTC can be calculated using the following formula:

CTC = Gross Salary + Direct Benefits + Indirect Benefits + Saving Contributions + Deductions.

For example, consider an employee with a basic salary of ₹15,000 per month. Let us also assume that their employer pays them ₹4,000 and a special bonus of ₹1,000 each month. Hence, their monthly CTC will be:

CTC = 15000 + 4000 + 1000 + (12% of 15000 for EPF).

What is Gross Salary?

Gross salary refers to an employee’s salary before the deductions. It is visible as the final amount in payslips and is taxable under the Indian Income Tax Act of 1961.

The gross salary of an employee can be calculated using the formula:

Gross Salary = Basic Salary + Additional Allowances + Incentives / Bonuses.

What is the difference between Gross Salary and CTC?

While CTC is the cost the employer bears to manage and sustain an employee, the gross salary is the amount they receive every salary cycle, and hence, the amount mentioned on their payslips, generated using their employee self service portal. Hence, gross salary is a part of CTC. As a result, the gross salary is the amount an employee receives before any taxes are deducted.

What are the benefits included with CTC in India?

There are numerous benefits associated with CTC in India. While some of these are direct benefits, others provide indirect benefits to the employee. Additionally, due to statutory guidelines, Indian employees are also eligible for long-term savings. So, let us check these benefits covered under CTC in India.

1. Direct Benefits

➔ Basic Pay

Basic pay is the compensation the employee receives for fulfilling their responsibilities within their organization. It is the compensation for undertaking their duties on time, as well as dedicating their time and effort for the organization’s work.

➔ Inflation Matching

Through Dearness Allowance (DA), employers enable their employees to match the rate of inflation, enabling a better lifestyle. DA also enables the companies to make their staff stay for longer with their organization.

➔ Conveyance

Through transport allowance, companies compensate their staff for their daily commute to their workplace. As a result, they can ask their staff to be on time and work for the stipulated hours.

➔ House Rent

Through House Rent Allowance (HRA), employers help their staff with their accommodation needs. This benefit enables them to relocate and stay near company premises, making their life easier.

➔ Medical Expenditure

Since medical expenses are a part of life, companies also provide Medical Allowances to their staff. It helps them pay for treatments on time and stay healthy, proving to be productive for their organization.

➔ Travel Expenses

Similarly, Leave Travel Allowance (LTA) enables the staff members to pay for their vacation travel expenses. They will be able to balance their work and life through such vacations, which also helps them stay with their organization for longer.

➔ Performance Incentives

Additionally, performance incentives and bonuses motivate the staff members to undertake their work well. It can be calculated using robust performance management system, which improves the organizational productivity, thereby increasing the quality and quantity of their goods and services.

2. Indirect Benefits

➔ Health Care

On the other hand, health care is an indirect benefit of the CTC since it is not a salary component per se. However, companies do provide medical insurance in case of emergencies and hospitalization, which alleviates the stress resulting from such scenarios.

➔ Commute

Since daily commute is directly covered under conveyance allowance, the indirect benefit of commute applies when the company arranges for employee travel through either taxi or bus services.

➔ Loans

Similarly, employees are also provided loans against salaries. The loan amount and their eligibility are dictated by their CTC. Hence, it is an indirect benefit of their CTC.

➔ Meals

Some companies also provide their staff with meal allowances or canteen options, which help them have a healthy break. It improves the brand reputation, while also helping the staff remain healthy.

➔ Accommodation

Similarly, companies also provide accommodation to allow their staff to live near their workplace or even provide dedicated staff quarters. Such measures are also an indirect benefit of their CTC.

3. Long-term Savings

➔ Gratuity

Since Gratuity is paid only to those employees who have completed a specific number of years, it motivates them to stay longer with their organization, while also being an indirect benefit for the employee.

➔ Pension

Since the Employee Provident Fund (EPF) acts as a long-term savings option, it is a benefit of the CTC since 12% of the employee’s Basic Pay is deducted for being deposited into their EPF.

What is In-hand Salary?

The In-hand Salary or Net Salary refers to the final amount that is shared with the employee every salary cycle, after removing all statutory and other deductions as defined by their employment contract. Hence, we can formulate the In-hand Salary to be:

In-hand Salary / Net Salary = Gross Salary – Professional Tax – Income Tax – Employee Provident Fund – Gratuity.

FAQs on Cost to Company (CTC)

1. Is the Cost to Company (CTC) the same as the take-home salary?

No. While CTC refers to the total cost incurred by the company in employing and sustaining an employee, the take-home salary refers to the final amount that is shared with the employee every salary cycle, after all deductions.

2. What is the difference between CTC and in-hand salary?

The Cost-to-Company (CTC) is the cost that the company incurs in recruiting, managing, and sustaining the employee. On the other hand, In-hand salary refers to the final amount shared with the employee after all statutory and other deductions, additional taxes, other benefits, and more.

3. What is CTC full form?

The full form of CTC is Cost To Company. CTC is the total cost a company spends on an employee. As a result, it includes all the components of the employee salary that the company is spending on their employee.

4. How to calculate 30% hike on CTC?

To calculate a 30% hike on CTC, use the formula:

New CTC = 0.3 x current CTC + current CTC.

For example, if the current CTC is ₹5 lakhs, the new CTC after a 30% hike would be ₹6.5 lakhs according to the formula:

0.3 x 500000 + 500000 = 650000

5. Is CTC monthly or yearly?

CTC is usually expressed as an annual figure. Officially, CTC is considered as the yearly expenses spent on an employee by their organization. Hence, unless specified otherwise, CTC is always inferred to be yearly.

6. Is gratuity a part of CTC?

Since CTC includes all expenses borne by the company in sustaining an employee, it includes all components of the salary including their gratuity, along with their basic pay, Professional Tax, Income Tax, additional allowance, etc.

7. Is variable pay a part of CTC?

Since CTC includes all expenses that are borne by the organization in maintaining an employee, it includes all salary components including variable pay, additional incentives and bonuses, as well as any other forms of payment which can vary each salary cycle.

8. What is variable pay in CTC?

Variable pay is a component of CTC that enables the employer to pay their staff based on the conditions set for the variable pay. For example, a specific company would stipulate that their employees will receive their variable pay only if their company makes a specific amount in profits.

9. Is CTC higher than salary?

CTC is the total cost to the company to keep an employee employed with their company. Hence, it is higher than the salary that the employee receives in their account since the statutory deductions such as EPF, PT, IT, ESIC, etc. would have already been deducted.